Land Remediation Relief is a UK corporation tax relief that supports the clean up and redevelopment of contaminated or derelict land acquired from a third party, where the company did not cause the contamination or dereliction.

When eligible, it can significantly reduce a company’s Corporation Tax bill and can improve project cash flow.

What is Land Remediation Relief

Land Remediation Relief allows companies to claim enhanced tax relief on qualifying remediation costs. In most cases, companies can deduct 150 percent of eligible expenditure from their taxable profits (100 percent of the cost plus an additional 50 percent deduction).

If the enhanced deduction creates or increases a loss, that loss may be surrendered for a payable tax credit, creating a direct cash benefit.

What costs can qualify

Qualifying costs typically include

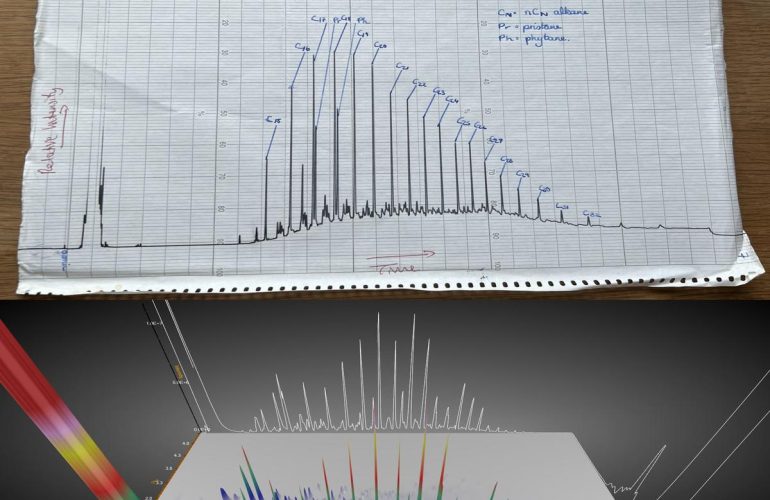

• Ground investigation and environmental site investigations

• Laboratory testing and risk assessment

• Removal, treatment or containment of contaminated soils or groundwater

• Remediation design and implementation

• Validation and verification works required to make land suitable for use

The contamination or dereliction must arise from historic site conditions and must not have been caused by the company (or connected parties) making the claim.

Who can claim

• UK companies subject to Corporation Tax

• Companies with a major interest in the land, typically freehold ownership or a lease with at least seven years remaining

Can it be claimed retrospectively

Yes, but the time limits matter. A Land Remediation Relief claim is normally made in the company tax return and is commonly described as needing to be made within two years of the end of the accounting period in which the qualifying expenditure was incurred.

If a return is already out of time to amend, an overpayment relief claim may be possible, subject to conditions and a typical four year time limit from the end of the relevant accounting period.

Why technical evidence matters

Clear environmental and geotechnical reporting is essential. Claims should demonstrate

• The presence and nature of contamination or dereliction

• That it pre-dated the company’s ownership or involvement

• That remediation works were necessary and carried out

Well documented ground investigation and remediation records can make a material difference to the strength of a claim.

Why this matters

Land Remediation Relief can transform the financial viability of brownfield sites, reduce overall development costs, and unlock cash benefits on complex ground conditions.

It remains one of the more generous UK tax reliefs available for qualifying remediation on redevelopment projects.

If you think you may be eligible, get in touch to discuss your project.